by Marshall Allen Republished with permission

Read more and sign up for Marshall's free newsletter here.

My son called me the other day with the type of news no parent wants to hear.

“Dad, I need to go to the emergency room. I might have a blood clot in my lung.”

“What!!!???”

Don’t worry: It turns out that my son did not have a pulmonary embolism. Thankfully, this story isn’t about a medical problem. This story is about how you protect yourself from getting overcharged at the emergency room. I recommend altering your financial agreement with the hospital so it includes The Battlefield Consent.

Let me walk you through it.

At some point when you go to the emergency room, you’re going to be told to sign a document that says you accept financial responsibility for the care that’s provided to you. It’s typically at the beginning of your visit. This is a contract. It’s not wise to sign any contract without reading it and negotiating so it’s fair to you. The same is true as a health care patient.

I previously wrote in this newsletter about how you can alter your financial agreement at your doctor’s office. In my book, “Never Pay the First Bill: And Other Ways to Fight the Health Care System and Win,” I show how to do it in the emergency room. In this case my son and I applied my written advice in real life. This is practical stuff!

My son Ashton is an 18-year-old freshman at Grand Canyon University in Phoenix. I just have to give him a shout out here, because he is a great kid! About a week before his ER trip, he had donated plasma at a blood center. The nurse had trouble accessing his vein and caused some minor bruising in his arm. Then he had a severe pain in his back, behind his right shoulder blade, and difficulty breathing deeply. He went to a doctor at a campus clinic, and the physician wondered if the vein damage could have caused a blood clot that traveled to his lung. Yikes. That’s a scary thought.

I called a physician friend and he said it’s highly unlikely Ashton had a blood clot from donating plasma. I also researched complications associated with donating plasma. Blood clots are not mentioned.

But still. A pulmonary embolism can be deadly. If a doctor who checked him sent him to the ER, we had better get it checked. I live in Texas, so Ashton and I talked on the phone throughout his 10-hour ER visit. I researched the appropriate tests for checking out a blood clot and followed along with the care they recommended and provided. It sounds like they did what was appropriate to rule out a blood clot. So thankfully, this does not seem to be a story about overtreatment.

The Battlefield Consent is to ensure we don’t get hit with outrageous medical bills. Patients are extremely vulnerable to price gouging in the emergency room. Hospitals can charge virtually any amount for the tests and treatment. The prices negotiated by insurance companies may not be fair to patients.

I got introduced to altering emergency room consent forms from Dr. Marty Makary and Al Lewis, founder of the health literacy company Quizzify. Makary writes about The Battlefield Consent in his book, “The Price We Pay,” which I edited and highly recommend. Lewis, who graduated from Harvard Law School and is a licensed attorney, calls Quizzify’s version the “Prevent Consent.” He has developed the idea a lot and wrote a backstory about its history and iterations. Quizzify has seen so much success with its Prevent Consent that it launched a service that guarantees a patient’s emergency room bill won’t exceed $1,000. The service does cost a fee and the individual has to be enrolled before the ER visit, and then follow the action steps or consult the experts provided by Quizzify.

What I’m talking about here is the Do-It-Yourself version. Essentially, you want to put a limit on what you agree to pay at the emergency room. Commercial insurance rates are notorious for their variation. Medicare, the federal government’s insurance plan for people who are disabled and over age 65, typically has the lowest rates. Commercial insurers like Blue Cross, or Aetna or UnitedHealthcare, may have rates that are anywhere from two-times the Medicare rate, to 10 times the Medicare rate. If you don’t put a limit on what you agree to pay, you might end up getting a bill that’s extremely unfair.

Here's how you set the limit. The financial agreement is typically on a clipboard, or if it’s electronic, it may be on an iPad or other computer screen. The people at the front desk usually expect you to blindly sign it. In Ashton’s case, they presented him with a screen with a blank space to put his signature. The terms of the agreement couldn’t even be seen. That’s not a fair way to inform a patient of his financial obligations! This happened as he was being discharged. It was 1 a.m. in Phoenix, and 3 a.m. for me, so both of us were tired.

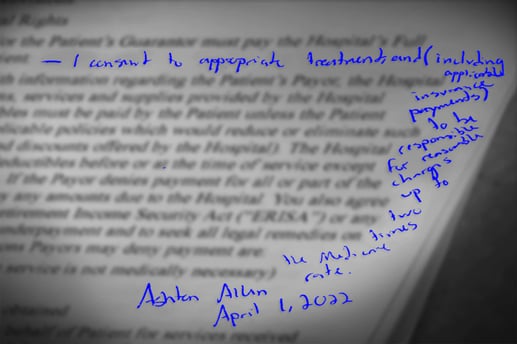

Ashton had them print the whole agreement so he could write in The Battlefield Consent. It turns out there was a lot of important fine print. The hospital’s “Financial Agreement” said, “Subject to the limitations below…” the patient must pay the hospital’s full charges. The Battlefield Consent was Ashton’s limitation, so he wrote it into that section. I used his altered consent form as the main image on this newsletter, so you can see it for yourself. But I know it’s hard to read his handwriting. Here’s what he wrote: “I consent to appropriate treatment and (including applicable insurance payments) to be responsible for reasonable charges up to two times the Medicare rate.”

In other words, Ashton agreed to pay up to twice the Medicare rate for appropriate treatment – and his payment would include what our family’s insurance policy would pay. Quizzify’s most recent consent language adds the requirement of an itemized medical bill and appropriate medical billing codes.

Ashton took a photo of the revised form, so we have a copy for our records. He asked the person at the front desk to make a photocopy, and insert the altered copy into his file. The harried woman at the front desk did not argue with him.

The Battlefield Consent set a fair limit on what we agree to pay. Now we need to wait and see how the hospital handles the bills. They might not respect Ashton’s limitations. I lay out the pathway for making sure medical bills are fair and accurate in my book. I also show how to contest medical bills, if necessary. Ashton might even need to defend himself in small claims court if the bills are unfair – as this mom successfully did recently with Sutter Health. He’s ready to do that if he needs to - and his revised financial agreement will help.

It’s sad to say this, but when it comes to health care billing, you can hope for the best, but you have to prepare for the worst.

Action steps:

1. When you go to the emergency room, alter your financial agreement to limit the amount you agree to pay. You can use Quizzify’s most recent language, or write what my son wrote: “I consent to appropriate treatment and (including applicable insurance payments) to be responsible for reasonable charges up to two times the Medicare rate.”

2. Make sure your altered agreement gets added to your medical record.

3. Take a photo of your modified financial agreement for your records.

For more great content, subscribe to best-selling author Marshall Allen's free newsletter here.